Employee Leasing in Bulgaria

With its great location at the crossroads of major European trade routes, its highly-stable economy and political landscapes, and its competitive labor costs and tax incentives, Bulgaria provides businesses with attractive opportunities for business expansion. Companies can quickly gain access to all the advantages the Bulgarian business environment offers by using the employee leasing services offered by FMC Group.

Employee leasing allows businesses to quickly expand their activity into the Bulgarian market while enjoying unmatched flexibility and reduced costs. FMC Group provides clients with comprehensive support during the entire recruitment process, as well as during the operational phase of employees. This allows businesses to achieve remarkable results in short periods of time.

Content:

- Advantages of Employee Leasing in Bulgaria

- Employee Leasing Services Offered by FMC Group

- Advantages of the Bulgarian market

- Recruitment in Bulgaria

- Minimum Wage and Payroll

- Social Contributions and Taxes

- Working Hours and Overtime

- Vacation Days

- Parental Leave and Sick leave

- Notice Period

Get in touch with us

Advantages of Employee Leasing in Bulgaria

- Expanding business into Bulgaria through employee leasing gives clients the opportunity to enter the Bulgarian market as quickly as possible and benefit from the unlimited access it gives to the market of the European Union.

- Employee leasing allows clients to focus their energy on their growth strategy, as FMC Group handles the entire administrative and legal aspects relating to their expansion.

- Clients who expand into the Bulgarian market through employee leasing enjoy very high flexibility that significantly lowers their expansion costs and investment risk.

Employee Leasing Services Offered by FMC Group

- Selection of the candidates that match the client’s requirements;

- Negotiation of employment contracts and signing with successful candidates after the client’s approval;

- Payment of taxes and social contributions of employees according to the Bulgarian law;

- Provision of accounting services according to international standards;

- Payment of all types of expenses after the client’s approval;

- Monitoring of the paid vacations of employees in coordination with the client and in accordance with local regulations;

- Negotiation and implementation of private health insurance for employees if requested;

- Giving clients regular updates about the situation of their employees.

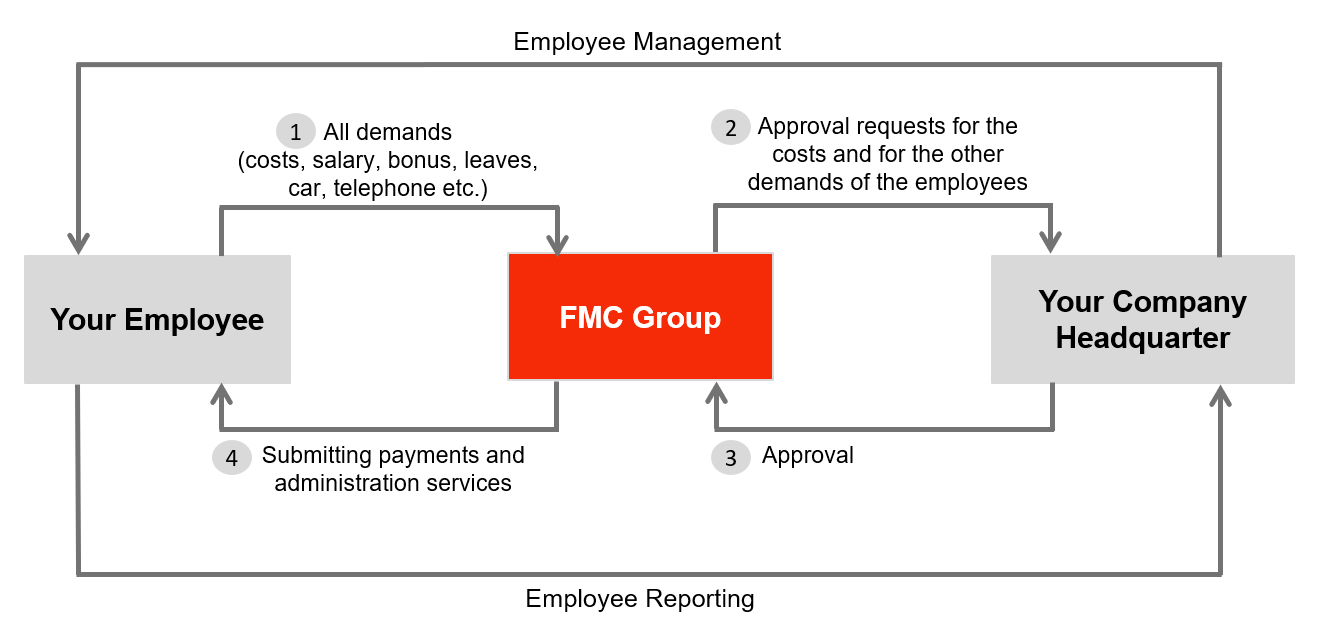

Management and Reporting Flow of Employee Leasing Services

Advantages of the Bulgarian Market

- Located in the heart of the Balkans, Bulgaria has a strategic location at the crossroads of five different Pan-European transport corridors: Corridor IV (running from Germany to Turkey through seven other countries), Corridor VII (running along the Danube River), Corridor VIII (running from Albania to Bulgaria through North Macedonia), Corridor IX (running from Finland to Greece through six other countries), and Corridor X (running from Austria to Greece through four other countries). Moreover, Bulgaria is a participating state in the Transport Corridor Europe-Caucasus-Asia (TRACECA) program, one of the largest intergovernmental logistics projects linking the West and the East.

- Bulgaria has renowned infrastructures, including four major airports in Sofia, Plovdiv, Bourgas, and Varna, and two main seaports in Varna and Bourgas, as well as numerous ports along the Danube River.

- Expanding into Bulgaria gives access to the market of the European Union with its population of nearly 450 million, as well as the markets of Turkey, the Middle East, and the Commonwealth of Independent States (Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, and Uzbekistan).

- As a member of the European Union and the NATO alliance, Bulgaria enjoys great political stability. Bulgaria’s currency, the Lev, is also pegged to the Euro at a fixed exchange rate, which provides the country with important macroeconomic stability.

- Bulgaria has a very friendly tax regime. The country’s corporate tax rate is one of the lowest in the European Union at only 10%. The Bulgarian government even fully exempts some businesses from corporate tax if they invest in regions with a high unemployment rate.

- To read more about what Bulgaria has to offer, you can visit Invest Bulgaria Agency.

- Bulgaria Ministry of Labor and Social Policy is another valuable source to discover Bulgaria’s social economy.

Recruitment in Bulgaria

Minimum Wage and Payroll

- The national monthly minimum wage in Bulgaria is set at BGN 720 (EUR 369).

- The payroll cycle in Bulgaria is generally monthly, with salaries being paid on the last working day of the month.

Social Contributions and Taxes

| Employer Contributions | |

| Social Security | 13.72% |

| Health Insurance | 4.80% |

| Work Accident and Occupational Illness Fund | 0.40% – 1.10% |

| Total | 18.92% – 19.62% |

| Employee Contributions | |

| Social Security | 10.58% |

| Health Insurance | 3.20% |

| Total | 13.78% |

| Employee Income Tax | |

| Flat Rate | 10.00% |

Working Hours and Overtime

- Bulgarian law defines the working hours limit at eight hours per day and 40 hours per week.

- Overtime work is paid at a rate of 150% of the regular salary on working days, 175% on weekends, and 200% on public holidays.

- The legal limit of overtime work is set at three hours per day, six hours per week, 30 hours per month, and 150 hours per year.

Vacation Days

- Employees in Bulgaria are entitled to a minimum of 20 days of paid leave per year after their first four months of service.

- Bulgaria commemorates 10 public holidays:

- New Year’s Day: January 1st

- National Holiday: March 3rd

- Good Friday and Easter Monday: Between March and April (moveable)

- Labor Day: May 1st

- George’s Day: May 6th

- Day of Enlightenment: May 24th

- Unification Day: September 6th

- Independence Day: September 22nd

- Christmas Holiday: December 24th – December 26th

Parental Leave and Sick Leave

- Pregnant employees can take up to 410 days of paid maternity leave. The leave cannot be shorter than 135 days. It can be taken 45 days before the delivery date. Pay during the leave is covered by social security at a rate of 90% of the regular salary.

- New fathers are entitled to a mandatory paternity leave of 15 days after the birth of their child if they have completed at least one year of employment. Social security covers pay at a rate of 90% during this period.

- Once the newborn is six months old, remaining maternity leave days can be shared between both parents, with the mother’s consent.

- Employees can take a sick leave for up to 18 months. The first three days are paid for by the employer at a rate of 70% of the regular salary. From the fourth day, social security covers pay at a rate of 80%, or 90% if the sick leave is due to a work-related injury.

- Employees can take two days of paid leave in the event of the death of an immediate family member or if they get married.

Notice Period

- The legal minimum notice period in Bulgaria is set at 30 days, but it is common to increase the duration to 90 days in employment contracts.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.