Employee Leasing in Canada

As one of the world’s largest economies, Canada is a favorite destination for businesses wishing to expand their activity into North America. The country’s location, close to the world’s largest consumer market – the US, and its numerous free trade agreements make it a great option for business expansion.

Expanding activity into Canada through employee leasing allows companies to significantly reduce investment risk and cost, helping them to gradually measure their growth potential in the country. Employee leasing also allows businesses to comply with local regulations without setting up a local subsidiary, which gives them the chance to fully concentrate on their business strategies.

Content:

- Advantages of Employee Leasing in Canada

- Employee Leasing Services Offered by FMC Group

- Advantages of the Canadian Market

- Recruitment in Canada

- Minimum Wage and Payroll

- Social Contributions and Taxes

- Working Hours and Overtime

- Vacation Days

- Parental Leave and Sick leave

- Notice Period

Get in touch with us

Advantages of Employee Leasing in Canada

- Expanding business activity into Canada through employee leasing allows clients to enter the local market with unmatched ease and flexibility.

- Employee leasing allows clients to focus on business decisions and let FMC Group take care of the administrative management of employees.

- Recruiting local employees in Canada improves clients’ competitiveness thanks to the quality of the Canadian labor force.

- Employee leasing lets clients benefit from the highly-skilled Canadian talent pool without setting up a local company.

Employee Leasing Services Offered by FMC Group

- Searching for candidates that perfectly match the client’s requirements;

- Negotiating and signing employment contracts;

- Paying all types of expenses and allowances;

- Paying taxes and social contributions in accordance with local regulations;

- Managing the payroll according to international standards;

- Monitoring paid leaves;

- Negotiating and implementing private health insurance if requested;

- Maintaining regular contact with clients regarding the management of their employees.

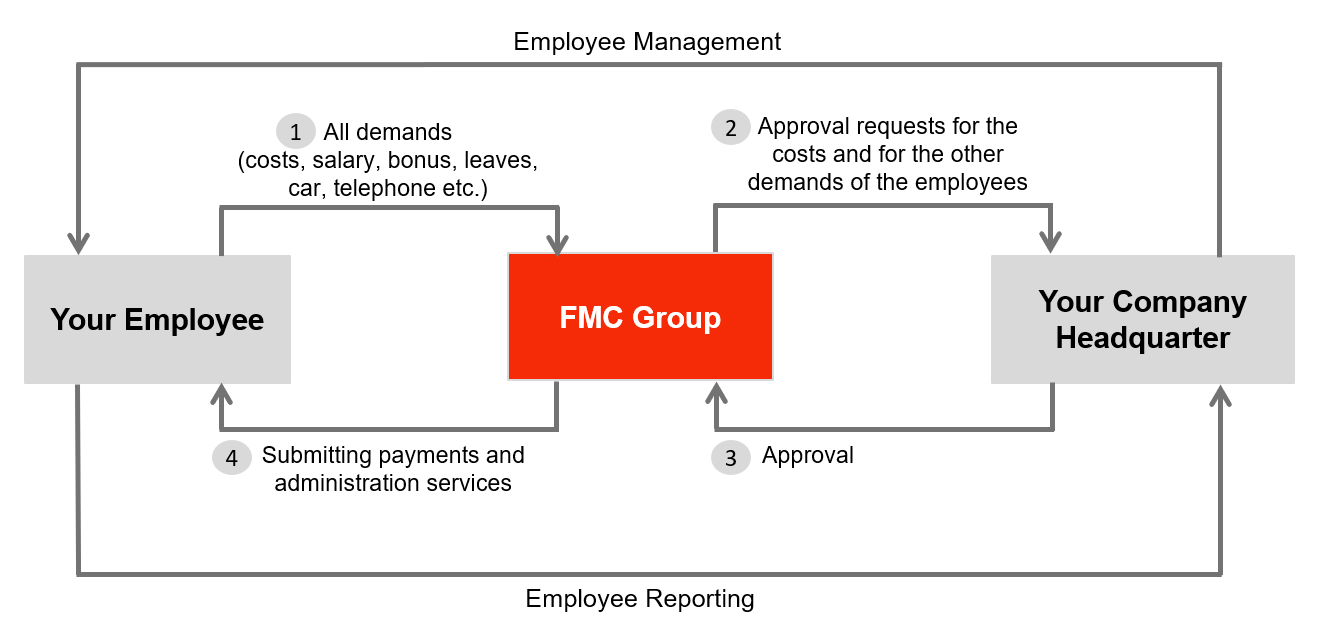

Management and Reporting Flow of Employee Leasing Services

Advantages of the Canadian Market

- Canada has an optimal location for companies wanting to grow internationally. It not only represents a lucrative market in itself but also offers access to the large US and EU markets thanks to its free trade agreements.

- Canada’s economy is the 10th-strongest in the world, which provides a good foundation for a successful business expansion. Moreover, the Canadian population has one of the highest disposable incomes in the world, estimated at more than USD 31,400 per capita per year, which makes Canadian consumers more likely to purchase various types of products and services.

- The Canadian economy is very stable thanks to its diversity, as it has many flourishing industries. Canada is a global leader in agriculture, forestry, and fisheries. It is also the world’s fourth-largest oil producer.

- The cost of doing business in Canada is relatively low in comparison to some other developed countries. For instance, the net corporate tax rate is as low as 15%. The country offers many federal tax reductions to encourage investment. Canada has also ranked 23rd worldwide in the World Bank’s 2020 Doing Business ranking.

- Further useful information about Canada’s investment potential can be found on Invest in Canada.

- Canadian Government – Employment and Social Development is a valuable source to discover Canada’s social potential.

- Canada Employment Insurance Commission is another source for a deeper read on Canada’s labor environment.

Recruitment in Canada

Minimum Wage and Payroll

- The hourly minimum wage in Canada varies by province, between CAD 11.45 (EUR 8.68) and CAD 16.00 (EUR 12.13). It is at its lowest in the Saskatchewan province (south) and its highest in the Nunavut province (northeast).

- Salaries in Canada are usually paid bi-weekly or monthly.

Social Contributions and Taxes

| Employer Contributions | |

| National Pension | 5.70% |

| Federal Employment Insurance | 2.21% |

| Total | 7.91% |

| Employee Contributions | |

| National Pension | 5.70% |

| Federal Employment Insurance | 1.58%* |

| Total | 7.28% |

| Employee Income Tax | |

| Up to CAD 49,020 per year (EUR 37,150) | 15.00% |

| Between CAD 49,020 and CAD 98,040 (EUR 37,150 – EUR 74,300) | 20.50% |

| Between CAD 98,040 and CAD 151,978 (EUR 74,300 – EUR 115,178) | 26.00% |

| Between CAD 151,978 and CAD 216,511 (EUR 115,178 – EUR 164,085) | 29.00% |

| From CAD 216,511 (EUR 164,085) | 33.00% |

* 1.20% in the Quebec province.

Working Hours and Overtime

- Legal working hours in Canada cannot exceed 44 hours per week and eight hours per day.

- Overtime work on regular days is paid at a rate of 150% of the employee’s regular salary.

- On weekly rest days and public holidays, overtime pay has to be equal to at least three hours of pay at the minimum wage.

Vacation Days

- Employees in Canada have the right to a minimum of two weeks of annual paid leave after 30 days of service. The leave is extended afterward to three or four weeks per year, depending on the province.

- Canada commemorates five nationwide public holidays, in addition to several provincial and territorial holidays. The nationwide holidays are as follows:

- New Year’s Day: January 1st;

- Good Friday: Between March and April (moveable);

- Canada Day: July 1st;

- Labor Day: First Monday in September (moveable);

- Christmas Day: December 25th.

Parental Leave and Sick Leave

- Female employees in Canada are entitled to 16 weeks of paid maternity leave, which can start any time within the 13 weeks preceding birth. Employment insurance covers pay during maternity leave at a rate of up to 55% of the regular salary.

- New fathers or employees who adopt a child are entitled to 62 weeks of unpaid leave within 78 weeks of the child being placed in their care.

- Employees in Canada are entitled to 16 weeks of sick leave per year. Pay during sick leave is covered by employment insurance at a maximum rate of 55% of the regular salary.

Notice Period

- The notice period in Canada varies between one and eight weeks, depending on the employee’s seniority.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.