Employee Leasing in Nigeria

Nigeria’s large consumer market, infrastructure development, economic diversification, and favorable investment policies make it an appealing destination for business expansion. The Nigerian market offers many opportunities for business growth and development.

One of the easiest and quickest ways to enter the Nigerian market is to hire local employees through the employee leasing services offered by FMC Group. These services allow companies to expand into Nigeria without setting up a local subsidiary. They also help companies focus on their growth strategy and measure their business potential in the West African country in a very flexible manner, without having to worry about the day-to-day administrative management of employees.

Content:

- Advantages of Employee Leasing in Nigeria

- Employee Leasing Services Offered by FMC Group

- Advantages of the Nigerian Market

- Recruitment in Nigeria

- Minimum Wage and Payroll

- Social Contributions and Taxes

- Working Hours and Overtime

- Vacation Days

- Parental Leave and Sick leave

- Notice Period

Get in touch with us

Advantages of Employee Leasing in Nigeria

- Employee leasing in Nigeria significantly reduces operational costs by outsourcing recruitment and human resources management responsibilities to FMC Group.

- Employee leasing allows businesses to flexibly scale up or down their workforce based on market demands.

- Employee leasing helps companies enter the Nigerian market without worrying about compliance with local labor laws as FMC Group completely handles payroll processing, tax deductions, employee benefits administration, and regulatory compliance.

- Businesses that opt for employee leasing gain instant access to a large pool of qualified professionals who can quickly integrate the company and are very familiar with the local market.

Employee Leasing Services Offered by FMC Group

- Selection of candidates according to the client’s needs and criteria;

- Recruitment of the best candidates after the client’s approval and negotiation of employment contracts;

- Management of the payroll according to international standards;

- Payment of social contributions and taxes in accordance with Nigerian labor law;

- Payment of other expenses and allowances on behalf of the client;

- Monitoring of paid leaves and employee vacations according to the employment contract;

- Negotiation and implementation of private insurance for employees if requested;

- Continuous communication with the client regarding the management of their employees.

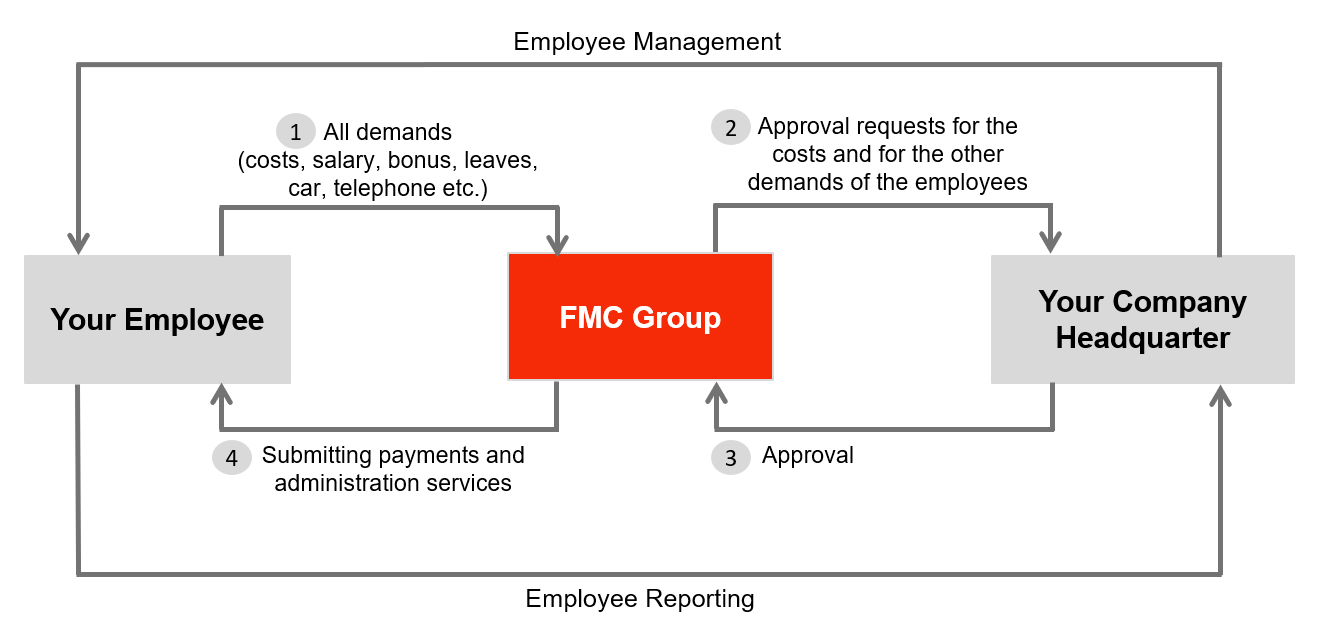

Management and Reporting Flow of Employee Leasing Services

Advantages of the Nigerian Market

- Nigeria has the largest population in Africa, with over 220 million people. This presents a vast consumer market with a growing middle class and increasing purchasing power. Expanding into the Nigerian market allows access to the widest customer base in Africa.

- The Nigerian government has been making significant efforts to improve infrastructure across the country. Many major infrastructure projects in transportation, power generation, telecommunications, and logistics are underway, providing a conducive environment for business operations.

- Nigeria’s economy is diversifying beyond oil and gas. The government has been promoting sectors such as telecommunications, technology, and services. This diversification strategy aims to reduce dependence on oil revenues and create a more resilient and balanced economy, providing opportunities for investors to participate in the growth of these sectors.

- The Nigerian government has implemented various reforms to attract foreign investment, notably tax incentives, special economic zones, and investment promotion agencies.

- In 2020, the Nigerian government launched a 10-year National Digital Economy Policy and Strategy with the aim of Nigeria becoming a continental hub for the IT sector. The strategy focuses on eight different axes and covers the development of both a skillful workforce and a solid IT infrastructure.

- Further details about the advantages of the Nigerian market are provided by the Nigerian Investment Promotion Commission (NIPC).

Recruitment in Nigeria

Minimum Wage and Payroll

- The national monthly minimum wage in Nigeria is set at 30,000 NGN (EUR 36.3).

- The payroll cycle in Nigeria can be either monthly, bi-weekly, or weekly.

- There are no legal requirements for the 13th-month salary bonus in Nigeria, but bonuses on special occasions, such as religious holidays or the end of the year are a common practice.

Social Contributions and Taxes

| Employer Contributions | |

| Pension | 10.0% (only for employers with more than 15 employees) |

| National Social Insurance Trust Fund (NSITF) | 1.0% |

| Industrial Training Fund (ITF) | 1.0% (only for employers with more than 4 employees) |

| Total | 1.0% – 12.0% |

| Employee Contributions | |

| Pension | 8.0% |

| Housing Fund | 2.5% |

| Total | 10.5% |

| Employee Income Tax | |

| Up to NGN 300,000 (EUR 363) per year | 7.0% |

| Between NGN 300,000 and NGN 600,000

(EUR 363 – EUR 725) |

11.0% |

| Between NGN 600,000 and NGN 1.1 million

(EUR 725 – EUR 1,330) |

15.0% |

| Between NGN 1.1 million and NGN 1.6 million

(EUR 1,330 – EUR 1,934) |

19.0% |

| Between NGN 1.6 million and NGN 3.2 million

(EUR 1,934 – EUR 3,868) |

21.0% |

| From NGN 3.2 million (EUR 3,868) | 24.0% |

Working Hours and Overtime

- Working hours in Nigeria cannot exceed 48 hours per week and eight hours per day.

- The value of overtime pay is not mandated by the law, but it must be mentioned in the employment contract.

Vacation Days

- Employees in Nigeria are entitled to at least 6 days of annual paid vacation after they complete one year of service. Unused vacation days can be carried over to the following year.

- Nigeria celebrates 12 public holidays:

- New Year’s Day: January 1st

- Armed Forces Remembrance Day: January 15th

- Good Friday and Easter Monday: Between March and April

- Workers’ Day: May 1st

- Children’s Day: May 27th

- Democracy Day: June 12th

- Independence Day: October 1st

- Christmas Holiday: December 25th – 26th

- Mawlid, Eid al-Fitr, and Eid al-Adha: They vary according to the Islamic calendar

Parental Leave and Sick Leave

- Female employees in Nigeria are entitled to 12 weeks of maternity leave at 50% of their regular salary. They become entitled to maternity leave after completing six months of service.

- New fathers are entitled to 14 working days of fully paid paternity leave.

- Employees in Nigeria are entitled to 12 days of paid sick leave per year. Any sick leave of more than two days requires the presentation of a medical certificate. Employees receive their full salary during sick leave.

Notice Period

- The duration of the notice period in Nigeria varies according to the seniority of the employees:

- Less than 3 months of service: 1 day

- Between 3 months and 2 years: 1 week

- Between 2 years and 5 years: 2 weeks

- More than 5 years: 1 month

Further Useful Information

- The website of the Nigerian Federal Ministry of Labor and Employment contains more detailed information about labor policies and regulations.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.