Employee Leasing in Singapore

Singapore has a reputation for being one of the best business destinations in Asia. Expanding into Singapore means joining thousands of other multinationals who decided to benefit from the country’s friendly regulations and thriving business environment. Singapore’s advanced infrastructures and attractive tax incentives allow companies to smoothly enter its market with minimal investment costs.

Through employee leasing, companies can easily and safely try out their business potential in Singapore. The employee leasing services offered by FMC Group give clients the opportunity to focus on their business growth strategy in Singapore without giving a second thought to administrative and regulatory procedures relating to the recruitment and management of local employees. The flexibility FMC Group offers also allows clients to significantly reduce investment risk.

Content:

- Advantages of Employee Leasing in Singapore

- Employee Leasing Services Offered by FMC Group

- Advantages of the Singaporean Market

- Recruitment in Singapore

- Minimum Wage and Payroll

- Social Contributions and Taxes

- Working Hours and Overtime

- Vacation Days

- Parental Leave and Sick Leave

- Notice Period

Get in touch with us

Advantages of Employee Leasing in Singapore

- Outstaffing to Singapore through employee leasing will put your business activity in the financial heart of Asia, where thousands of multinationals are already established.

- Employee leasing gives you the opportunity to instantly expand your business activity in Singapore and take full control of a local team.

- Through employee leasing, you can have quick and easy access to the highly-skilled workforce established in Singapore.

- Singaporean workers are incredibly familiar with international business standards and practices and are highly fluent in English. English is one of Singapore’s four official languages.

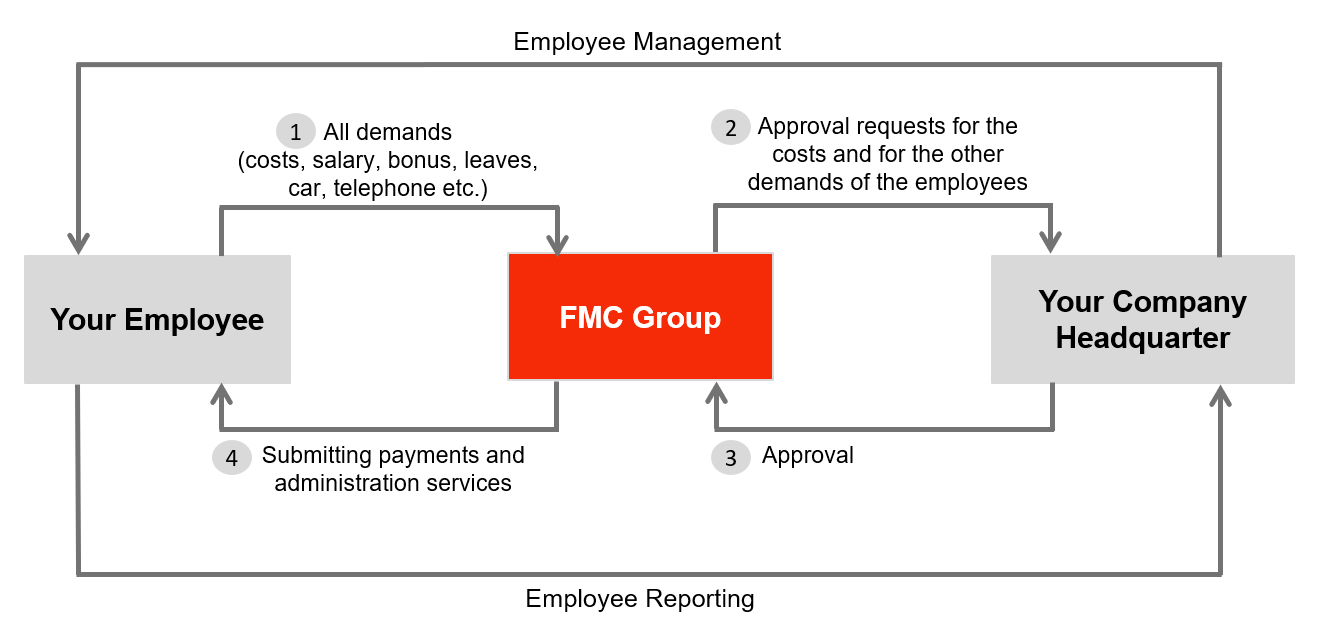

Employee Leasing Services Offered by FMC Group

- We select the best candidates that match your needs after a tailored search in the labor market and our established employee database.

- We negotiate and sign employment contracts according to your terms.

- We professionally manage your payroll accounting according to international standards and we pay all the necessary social security contributions and taxes according to local law.

- We pay all expenses and allowances after your approval.

- We monitor paid vacations and other leaves of your employees according to the local law.

- We negotiate and establish a private health insurance policy for your employees if needed.

- We maintain regular contact with you regarding employee management.

Management and Reporting Flow of Employee Leasing Services

Advantages of the Singaporean Market

- Singapore is located at the heart of Southeast Asia and provides great global connectivity. The country has signed more than 20 Free Trade Agreements, notably with China, the EU, India, Japan, Korea, Turkey, the UK, and the US, as well as over 80 Double Taxation Agreements.

- Singapore is a leading financial hub in Asia, thanks to the country’s policies to encourage trade, attract foreign direct investments, and welcome foreign businesses. According to the 2020 Global Financial Centres Index, Singapore is the third-largest financial center in the Asia-Pacific region and the sixth-largest in the world.

- According to the latest World Economic Forum’s Global Competitiveness Report, Singapore is the world’s most competitive economy, thanks to its road quality infrastructure, the efficiency of its seaport and airport services, and its sea transport connectivity, among other strengths.

- Singapore’s regulatory environment is highly conducive to setting up and operating business activity, thanks to its stable and efficient infrastructure. The country has ranked second in the World Bank’s 2020 Doing Business report.

- Singapore has one of the strongest protection systems for intellectual property. The country is home to the only World Intellectual Property Organization (WIPO) Arbitration and Mediation Center outside of Geneva. The Singaporean government also established a specialized intellectual property court back in 2002.

Recruitment in Singapore

Minimum Wage and Payroll

- Singapore does not have a national minimum wage, except for some very specific industries, such as cleaning and security.

- The Singaporean government has put in place a social assistance plan, called Workfare, that supports low-wage Singaporean workers who are aged 35 and above and earn a gross monthly income of less than SGD 2,300 (<EUR 1,560).

- Salaries in Singapore are generally paid monthly, before the last working day of each month.

- A 13th-month salary bonus is not mandatory, but it is customary.

Social Contributions and Taxes

| Employer Contributions | ||

| Central Provident Fund | 7.50% – 17.00% (reduces progressively with age) | |

| Skills Development Levy | 0.25% (capped at SGD 11.25 / EUR 7.62) | |

| Total | 7.75% – 17.25% | |

| Employee Contributions | ||

| Central Provident Fund | 5.00% – 20.00% (reduces progressively with age) | |

| Total | 5.00% – 20.00% | |

| Employee Income Tax | ||

| Up to SGD 20,000 per year | 0.00% | |

| Between SGD 20,001 and SGD 30,000 | 2.00% | |

| Between SGD 30,001 and SGD 40,000 | 3.50% | |

| Between SGD 40,001 and SGD 80,000 | 7.00% | |

| Between SGD 80,001 and SGD 120,000 | 11.50% | |

| Between SGD 120,001 and SGD 160,000 | 15.00% | |

| Between SGD 160,001 and SGD 200,000 | 18.00% | |

| Between SGD 200,001 and SGD 240,000 | 19.00% | |

| Between SGD 240,001 and SGD 280,000 | 19.50% | |

| Between SGD 280,001 and SGD 320,000 | 20.00% | |

| From SGD 320,001 | 22.00% | |

Working Hours and Overtime

- The legal working hours limit in Singapore is set at 44 hours per week.

- Overtime work in Singapore is legally capped at 12 hours per day and 72 hours per month.

- The payment for overtime work has to be at least 15% above the regular hourly rate of the employee.

- The maximum monthly overtime pay for employees is set at SGD 4,500 (~EUR 3,050) for “non-workmen” (employees who are not involved in manual labor) and at SGD 2,600 (~EUR 1,760) for workmen.

- Employers have to pay for overtime work of the previous month within 14 days of the salary period.

Vacation Days

- Employees in Singapore who have completed more than three months of service have the right to an annual paid leave of at least 7 days in their first year of service. The number increases by one day for each year of service afterward.

- The common practice in Singapore is for employers to grant their employees 14 to 20 days of paid leave after their first year of service.

- Singapore celebrates 10 public holidays (11 days):

- New Year’s Day: January 1st (1 day);

- Chinese New Year: Between January and February (2 days);

- Good Friday: Between March and April (1 day);

- Labor Day: May 1st (1 day);

- Vesak Day: Mid-May (1 day);

- National Day: August 9 (1 day);

- Deepavali: Between October and November (1 day);

- Christmas Day: December 26 (1 day);

- Hari Raya Puasa: First day after the Islamic month of Ramadan (1 day);

- Hari Raya Haji: Two months after the Islamic month of Ramadan (1 day).

Parental Leave and Sick Leave

- Pregnant employees who have been employed for more than three months before their child’s birth date are entitled to 16 weeks of maternity leave if the baby is Singaporean and 12 weeks if he is not. For the first and second child, the salary for the first eight weeks is fully paid by the employer and the remaining eight weeks are reimbursed by the government. From the birth of the third child, the entire duration of the maternity leave is covered by the government.

- Fathers who have been employed for more than three months are entitled to 2 weeks of paid paternity leave after their baby is born, to be taken within 16 weeks after the baby’s birth. The salary during the leave is covered by the Government Paid Paternity Leave fund.

- Employees who have completed six months of service are entitled to 14 days of sick leave per year if their illness does not require hospitalization. The duration is extended to 60 days per year if hospitalization is required.

- If employees have not completed six months of service, they are entitled to between 5 and 11 days of paid sick leave if no hospitalization is required and between 15 and 45 days if they need to stay at the hospital.

- Employees have to inform their employer of their inability to work due to sickness within 48 hours and provide a medical certificate when they return to work.

- Salaries are covered by the employer during paid sick leaves.

Notice Period

- The notice period for employees wishing to resign depends on the time they have spent working at the service of their employer.

- Employees who have worked for less than 26 weeks have to give one day’s notice.

- Employees who have worked between 26 weeks and 24 months have to give one week’s notice.

- Employees who have worked between 24 and 60 months have to give two weeks’ notice.

- Employees who have worked more than 60 months have to give four weeks’ notice.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.