Employee Leasing in Spain

Located in a strategic location with access to the Atlantic and the Mediterranean, Spain is at the crossroads of some major global trade routes. Expanding business activity in Spain means getting unrestricted access to the market of the European Union, as well as easy entry into the markets of the Middle East, North Africa, and Latin America.

The employee leasing services we offer at FMC Group allow businesses to easily expand their activity in Spain, at reduced costs and minimal risk. We provide clients with comprehensive support from the recruitment process to the day-to-day administrative management of employees. This helps clients focus exclusively on business decisions, without worrying about Spanish administrative and legal regulations.

Content:

- Advantages of Employee Leasing in Spain

- Employee Leasing Services Offered by FMC Group

- Advantages of the Spanish Market

- Recruitment in Spain

- Minimum Wage and Payroll

- Social Contributions and Taxes

- Working Hours and Overtime

- Vacation Days

- Parental Leave and Sick Leave

- Notice Period

Get in touch with us

Advantages of Employee Leasing in Spain

- Employee leasing in Spain gives clients access not only to the Spanish labor market but the entire European talent pool.

- Expanding business activity in Spain through employee leasing significantly enlarges the client’s potential, thanks to the country’s strategic location and friendly business environment.

- Employee leasing greatly facilitates expanding activity into a new country, as it allows clients to focus entirely on business decisions while FMC Group comprehensively handles the recruitment process and the administrative management of employees.

Employee Leasing Services Offered by FMC Group

- We search for and select the best candidates for your company;

- We conclude employment contracts with your best interest in mind;

- We provide accounting services that respect international standards;

- We pay taxes and social security contributions in accordance with Spanish law;

- We monitor your employees’ paid vacations;

- We implement private health insurance for your employees if requested;

- We maintain regular contact with you regarding the management of your employees.

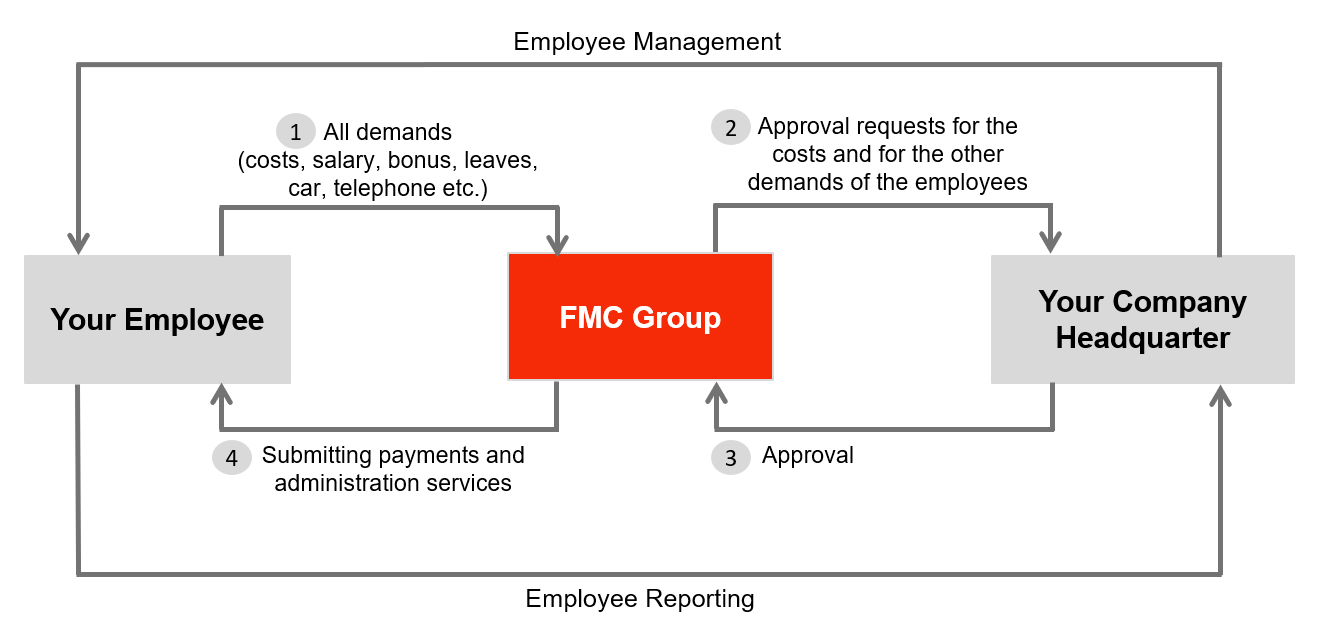

Management and Reporting Flow of Employee Leasing Services

Advantages of the Spanish Market

- Spain has a major economy that was able to surpass many of its European counterparts over the past few years. With a GDP of over EUR 1.3 trillion, Spain has the fourth largest economy in the European Union and the 14th largest in the world. Spain is also the world’s 13th-largest recipient of foreign investments, as more than 14,600 foreign companies are present in the country, including 70 of the top 100 firms in the Forbes Global 2000 ranking.

- Spain has a large domestic market that comprises 46 million inhabitants and over 80 million visitors each year (before the pandemic). Spain also has direct access to the European market with more than 500 million consumers, to the Middle East and North Africa region (500 million consumers), and Latin America (600 million consumers).

- Spain has a world-renowned infrastructure. In the World Economic Forum’s Global Competitiveness Report, the country ranked first in the world in terms of road connectivity, seventh in terms of overall infrastructure, and 11th in terms of the quality of road infrastructure. The Spanish infrastructure network includes 50 airports, 46 seaports, an over-17,000-kilometer-long network of highways and freeways, a 3,400-kilometer-long high-speed rail network, and over 150 logistics parks.

- Spain has one of the most advanced telecommunications and internet infrastructures in Europe. The country has the highest fiber internet penetration rate in the European Union, at 44%. Furthermore, ultrafast broadband covers 87% of the country, compared to an average of 60% in Europe.

- The Spanish labor force is highly skilled and educated. According to the Global Talent Competitiveness Index, Spain is the sixth country in the world and the third in Europe in the percentage of the population with higher education, at 46.5%. Spanish universities are known for producing professionals with skills and competencies that are highly valued.

- The Spanish Investment and Export Promotion Agency regularly shares news and information about the advantages of expanding business activity in Spain.

Recruitment in Spain

Minimum Wage and Payroll

- The national minimum wage in Spain is set at EUR 32.17 per day and EUR 965 per month.

- Salaries in Spain are paid monthly, generally on the last day of the month.

- The 13th– and 14th-month salary bonuses are mandatory in Spain. They have to be paid in July and December.

Social Contributions and Taxes

| Employer Contributions | |

| Social Security | 23.60% |

| Unemployment Insurance | 5.50% |

| Professional Training | 0.60% |

| Salary Guarantee Fund | 0.20% |

| Total | 29.90% |

| Employee Contributions | |

| Social Security | 4.70% |

| Unemployment Insurance | 1.55% |

| Professional Training | 0.10% |

| Total | 6.40% |

| Employee Income Tax | |

| Up to EUR 12,450 per year | 19.00% |

| Between EUR 12,450 and EUR 20,200 | 24.00% |

| Between EUR 20,200 and EUR 35,200 | 30.00% |

| Between EUR 35,200 and EUR 60,000 | 37.00% |

| Between EUR 60,000 and EUR 300,000 | 45.00% |

| More than EUR 300,000 | 47.00% |

Working Hours and Overtime

- The standard working limit in Spain is 40 hours per week divided into five days.

- Any work above the standard working limit has to be paid as overtime. The payment rate for overtime work is regulated by collective agreements.

- Overtime work cannot exceed 80 hours per year.

Vacation Days

- Employees in Spain are entitled to 22 working days of paid leave per year.

- Spain celebrates 10 nationwide public holidays:

- New Year’s Day: January 1st

- Epiphany: January 6th

- Good Friday: Between March and April (moveable)

- Labor Day: May 1st

- Assumption: August 15th

- National Day: October 12th

- All Saints’ Day: November 1st

- Constitution Day: December 6th

- Immaculate Conception: December 8th

- Christmas Day: December 25th

Parental Leave and Sick Leave

- Expectant mothers in Spain are entitled to 16 weeks of paid maternity leave, covered fully by social security. The duration is extended to 18 weeks in the case of a complicated delivery or multiple births. The first six weeks of the leave have to be taken directly before and after birth, but the remaining 10 weeks can be taken any time up to one year after birth.

- New fathers have the right to take 16 days of paid paternity leave, covered fully by social security.

- Employees in Spain are entitled to sick pay provided by the employer and social security. The first three days of sick leave are not paid unless the employer agrees to provide payment. Between the fourth and 15th days, the employer has to pay 60% of the employee’s salary. Between the 16th and 20th days, social security covers 60% of the salary. From the 21st day onward, social security covers 75% of the salary.

Notice Period

- The minimum notice period for resigning employees in Spain is set at 15 days unless a longer period is specified in the employment contract or collective agreements.

Further Useful Information

- The website of Spain’s Ministry of Labor contains a section dedicated to useful information about Spanish labor laws.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.