Employee Leasing in Switzerland

As one of the most innovative countries in the world, Switzerland offers great business potential for companies wishing to expand their activity, especially in the sectors of technology and research and development. The country has world-renowned infrastructures and its population has very high revenue and disposable income, making the Swiss consumer market very lucrative.

Employee leasing with FMC Group allows companies to easily benefit from the opportunities offered by the Swiss market. FMC Group accompanies businesses during the recruitment process and then completely handles the administrative management of employees, allowing companies to achieve very rapid growth.

Content:

- Advantages of Employee Leasing in Switzerland

- Employee Leasing Services Offered by FMC Group

- Advantages of the Swiss Market

- Recruitment in Switzerland

- Minimum Wage and Payroll

- Social Contributions and Taxes

- Working Hours and Overtime

- Vacation Days

- Parental Leave and Sick leave

- Other Types of Paid Leave

- Notice Period

Get in touch with us

Advantages of Employee Leasing in Switzerland

- Employee leasing in Switzerland helps companies reduce their business expansion costs, as it allows them to expand their activity into the Swiss market without setting up a local subsidiary.

- Companies that choose employee leasing can enter the Swiss market very quickly and enjoy great flexibility. This allows them to measure their business potential in the country as they go, allowing them to exit the market at minimal costs if needed.

- Employee leasing helps businesses fully focus on their growth strategy, while FMC Group handles administrative and regulatory procedures relating to their expansion.

Employee Leasing Services Offered by FMC Group

- Choosing candidates based on the client’s requirements;

- Recruiting the best candidates after getting the client’s approval;

- Negotiating employment contracts;

- Paying taxes and social contributions according to local regulations;

- Managing the payroll according to international standards;

- Paying other expenses and allowances;

- Monitoring paid leaves and other employee benefits according to employment contracts;

- Implementing private insurance for employees at the best rates if requested;

- Maintaining regular communication with the client about the management of their employees.

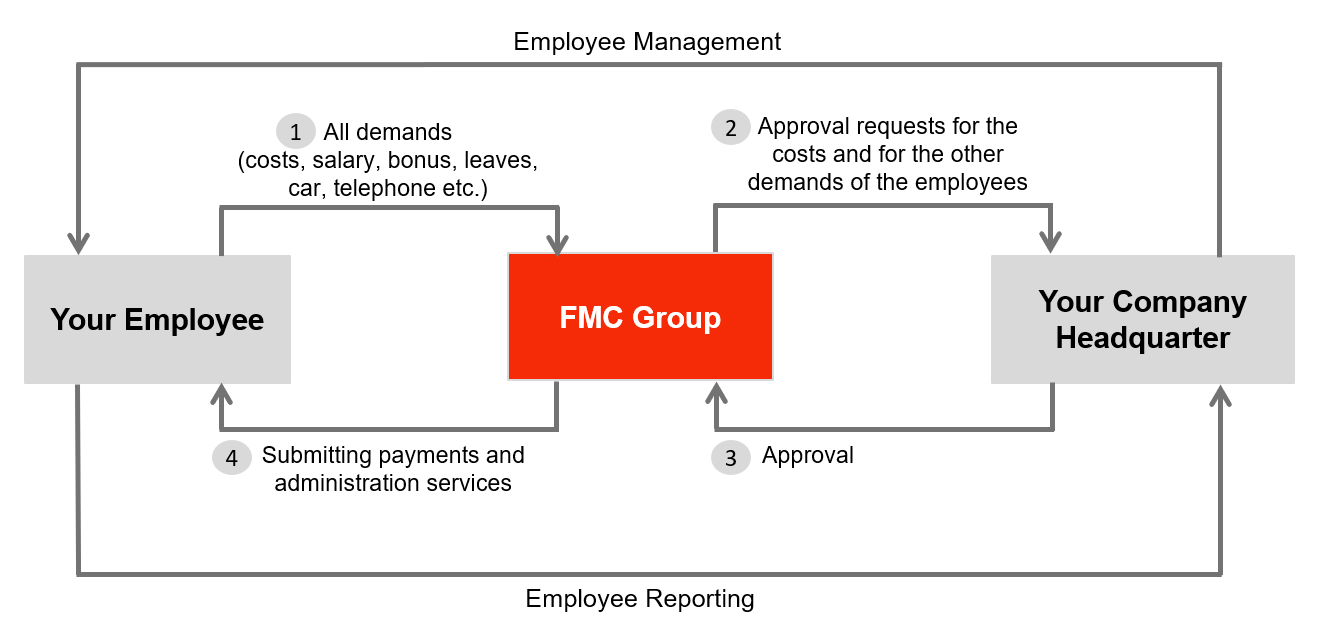

Management and Reporting Flow of Employee Leasing Services

Advantages of the Swiss Market

- Switzerland has one of the strongest economies in the world. It is ranked ninth in the world in terms of GDP per capita and 19th in terms of nominal GDP. The Swiss economy also enjoys great stability thanks to the strength of its innovation-based industries and its financial sector. The Swiss Franc is also one of the strongest and most stable currencies worldwide.

- Despite not being a member of the European Union, Switzerland has access to a very large number of markets in Europe and beyond. In fact, Switzerland has a network of free trade agreements with 43 different partners, including the European Union, Canada, Japan, China, India, Indonesia, the Gulf Cooperation Council, etc.

- Switzerland has very well-developed infrastructure networks, including a top-notch railway network, four international airports strategically placed across the country, and a modern river transportation network. Additionally, Switzerland has a strategic location in the heart of Europe, sharing borders with European powerhouses such as France, Germany, and Italy.

- Switzerland is highly focused on innovation and technology. The country has been ranking as the world’s most-innovative economy every year since 2011, according to the Global Innovation Index of the World Intellectual Property Organization. Switzerland has many world-renowned universities that attract young talented individuals from all around the world.

- The Swiss Trade and Investment Promotion Agency offers many useful guides about expanding business activity in Switzerland.

Recruitment in Switzerland

Minimum Wage and Payroll

- The minimum wage in Switzerland varies from one canton to another. Geneva has the highest minimum wage in the country, set at CHF 23 per hour.

- Salaries in Switzerland are paid monthly, generally around the 25th day of each month.

- The 13th-month salary bonus is not mandatory in Switzerland, but it is very common.

Social Contributions and Taxes*

| Employer Contributions | |

| Old Age and Disability Insurance | 5.30% |

| Family Compensation Fund | 2.45% |

| Unemployment Insurance | 1.10% |

| Occupational Accident Insurance | 1.00% – 4.00% |

| Supplementary Unemployment Insurance | 0.50% |

| Early Childhood Contribution | 0.07% |

| Maternity Insurance | 0.04% |

| Vocational Training Fund | CHF 31 |

| Total | 10.46% – 13.46%

+ CHF 31 |

| Employee Contributions | |

| Old Age and Disability Insurance | 5.30% |

| Unemployment Insurance | 1.10% |

| Supplemental Unemployment Insurance | 0.50% |

| Income Compensation | 0.22% |

| Maternity Insurance | 0.04% |

| Total | 7.16% |

| Employee Income Tax | |

| Up to CHF 17,663 per year | 0.00% |

| Between CHF 17,664 and CHF 21,281 | 8.00% |

| Between CHF 21,282 and CHF 23,409 | 9.00% |

| Between CHF 23,410 and CHF 25,537 | 10.00% |

| Between CHF 25,538 and CHF 27,665 | 11.00% |

| Between CHF 27,666 and CHF 32,985 | 12.00% |

| Between CHF 32,986 and CHF 37,241 | 13.00% |

| Between CHF 37,242 and CHF 41,498 | 14.00% |

| Between CHF 41,499 and CHF 45,754 | 14.50% |

| Between CHF 45,755 and CHF 73,420 | 15.00% |

| Between CHF 73,421 and CHF 120,238 | 15.50% |

| Between CHF 120,239 and CHF 161,736 | 16.00% |

| Between CHF 161,737 and CHF 183,017 | 16.50% |

| Between CHF 183,018 and CHF 261,757 | 17.00% |

| Between CHF 261,758 and CHF 278,782 | 17.50% |

| Between CHF 278,783 and CHF 392,636 | 18.00% |

| Between CHF 392,637 and CHF 615,022 | 18.50% |

| From CHF 615,022 | 19.00% |

* Social contributions and taxes vary slightly from one canton to another. Geneva is given as an illustrative example.

Working Hours and Overtime

- The legal working hours limit in Switzerland is set at 45 hours per week.

- Overtime work is paid at a rate of 25% higher than the regular pay rate or compensated with time off.

Vacation Days

- Employees in Switzerland are entitled to a minimum of four weeks of paid leave per year after they complete one year of service.

- Switzerland celebrates seven nationwide public holidays:

- New Year’s Day: January 1st

- Good Friday: Between March and April (moveable)

- Easter Monday: Between March and April (moveable)

- Ascension Day: Between May and June (moveable)

- Pentecost Monday: Between May and June (moveable)

- National Day: August 1st

- Christmas Day: December 25th

- Additionally, several holidays are celebrated only in some specific cantons.

Parental Leave and Sick Leave

- Expecting mothers can take up to 14 weeks of maternity leave. The salary during maternity leave is covered by social security at a rate of 80% of the regular wage.

- Fathers can take 10 days of paid paternity leave. Social security covers 80% of the employee’s salary during this leave.

- Parents are entitled to 14 weeks of paid leave, covered by social security at a rate of 80%, to provide care for their children if they are seriously ill or injured.

- Employees in Switzerland are entitled to three weeks of paid sick leave during their first year of employment. After they complete one year of work, they become entitled to benefit from a daily benefits insurance plan, under which they receive 80% of their regular salary for up to 720 days.

Notice Period

- Employees wishing to leave their job have to respect a notice period of one month if they have not completed one year of service.

- After one year of service and until the ninth year, the notice period is set at two months.

- After completing nine years of service, it is set at three months.

Further Useful Information

- You can access more detailed information about labor laws and social security in Switzerland on the website of the Swiss Federal Social Insurance Office.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.