Employer of Record Indonesia

Our Employer of Record Indonesia service enables clients to hire employees without the need to operate a local legal entity there.

It makes a big difference to develop a new market with your own personnel on the ground. Particularly for functions related to sales & marketing, business development, distributor management, and service & maintenance, our customers are very satisfied using our Indonesia Employer of Record Service.

Our customers and their local teams can be free of the distractions of administrative tasks and complex local requirements. So you can fully focus on the development of your core business.

If your local business grows large enough, you can easily transfer the employees to your own subsidiary. It also provides a quick exit strategy if necessary. In addition to Indonesia, we offer Employer of Record services in several other countries.

Content:

- Employer of Record Indonesia – FMC Group’s Approach

- Hiring an Employee

- Income Tax

- Typical Benefits

- Visa for the Employees

- Time off Policies

- Terminating an Employee

Get in touch with us

Employer of Record Indonesia - FMC Group's Approach

- Quick, flexible, and easy entry into Indonesia in compliance with local employment laws

- Complete control over business development with your own team

- Good option for building up, managing, and supporting your distributors and key accounts by directly observing local developments and adjusting the strategy whenever necessary

- Using our comprehensive recruitment experience for international clients, we can form a local team that fits your corporate culture.

- Focusing on your core business instead of dealing with the time-consuming and complex local administrative tasks

- Allowing for easy market exit if necessary

- Integrating your employees into our team through motivational events and special meetings

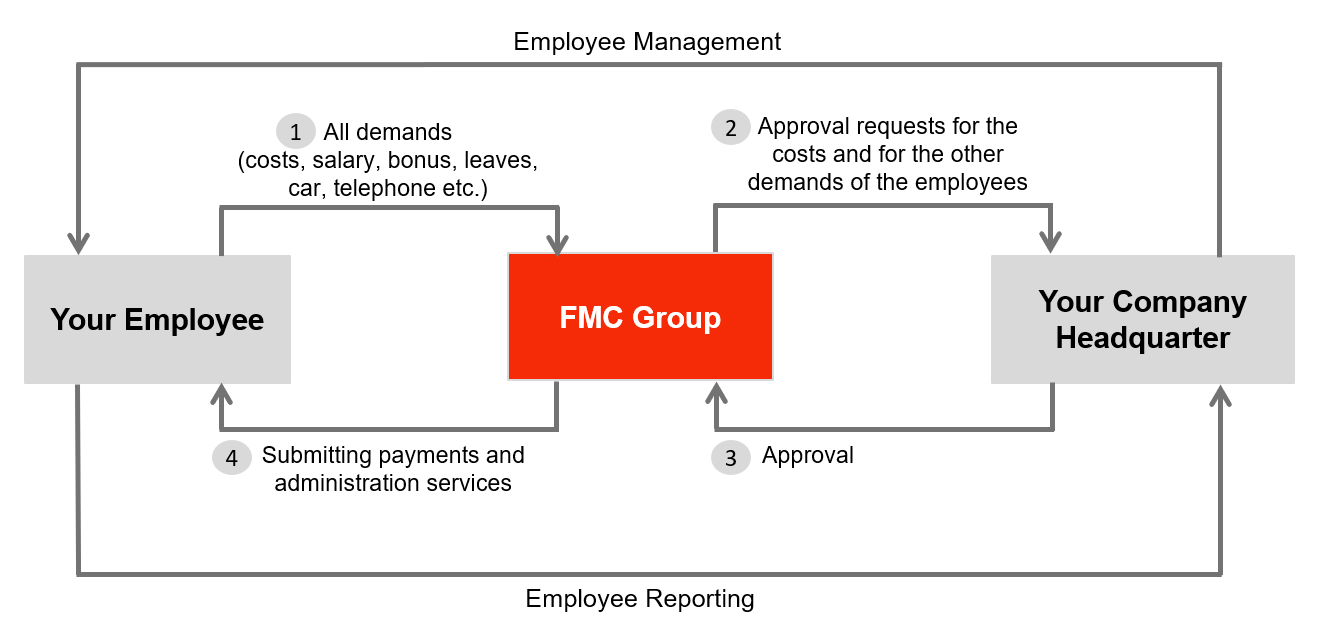

EOR Indonesia Management & Reporting Flow

Hiring an Employee

Indonesian labor and employment laws are typically seen as favoring employees. These laws offer a broad definition of employment and ensure that provisions such as social security are provided to all employees. While these laws apply to all Indonesian nationals working within the country, they do not extend to foreign nationals. Terminating employment in Indonesia is generally regarded as challenging, and there are various types of employment arrangements defined under Indonesian law.

Employment Contract – indefinite vs. fixed term

Fixed-term employment agreements in Indonesia must be drafted in Bahasa, the official language of the country. These contracts are typically limited to a duration of two years; however, they can be extended for an additional year if both parties mutually agree. Additionally, employment agreements of an unspecified duration are also permissible under Indonesian law.

Probation Period

In Indonesia, a probationary period of up to three months is permissible for any employee.

When terminating employment, employers must obtain the necessary permission from the Industrial Relations Court (IRC). Without the approval of the IRC, termination of the employment contract cannot occur, even with mutual consent. Although there is no mandatory notice period required before ending a contract, employers typically provide a 30-day period.

According to law, employees must receive severance pay upon dismissal. This typically amounts to one month’s pay for each year of service, capped at a maximum of nine years. The law also specifies circumstances under which employees cannot be terminated, such as during pregnancy, short-term illness, or upon joining a union.

Work Week, Overtime & Maximum Working Hours

In Indonesia, the standard work week consists of 40 hours, typically divided into either eight hours per day for five days or seven hours per day for six days.

When employers require employees to work beyond these regular hours, overtime pay is mandated. Overtime compensation generally equates to 1.5 times the employee’s base rate for the first overtime hour and 2 times the base rate for subsequent hours. The maximum allowable overtime in Indonesia is three hours per day or 14 hours per week.

Written agreements concerning overtime requests are obligatory in Indonesia and must be mutually agreed upon by the employee.

It’s worth noting that senior-level positions in Indonesia typically do not receive overtime compensation.

Income Tax

Residents of Indonesia are subject to the following income tax rates:

- Up to IDR 50 million: 5%

- From IDR 50 million to IDR 250 million: 15%

- From IDR 250 million to IDR 500 million: 25%

- Over IDR 500 million: 30%

Typical Benefits

In Indonesia, every company’s benefit management plan is required to encompass statutory benefits as mandated by law. This includes providing time off for the nation’s 14 public holidays. Additionally, employees may request additional time off to observe religious traditions.

Furthermore, after completing 30 days of employment, employees must be enrolled in the national social security program (BPJS). This program covers benefits such as workplace accident and death benefits, retirement pension, and healthcare.

- Health Insurance: Indonesia operates a compulsory universal healthcare system, wherein both employers and employees contribute towards funding healthcare insurance. This contribution amounts to approximately 5% of earnings and applies to both locals and expatriates.

Visa for the Employees

Foreign nationals who wish to work in Indonesia typically require two primary documents: a work visa and a work permit.

- Work Visa (Visa Izin Tinggal Terbatas/ITAS): This visa allows foreign nationals to enter Indonesia for the purpose of employment. It is typically issued for a limited duration and requires sponsorship from an Indonesian employer. The work visa is obtained from an Indonesian embassy or consulate abroad before entering the country.

- Work Permit (Izin Mempekerjakan Tenaga Kerja Asing/IMTA): The work permit is an official authorization issued by the Indonesian Ministry of Manpower (Kementerian Ketenagakerjaan) that allows foreign nationals to work legally in Indonesia. It specifies the type of work, employer, and duration of employment. The work permit must be obtained by the employer on behalf of the foreign employee before they start working in Indonesia.

Both the work visa and work permit are essential documents for foreign nationals to legally work and reside in Indonesia. They must be obtained in compliance with Indonesian immigration and labor laws.

Time off Policies

Public Holidays

Indonesia provides time off for public holidays, with the country recognizing 12 to 15 national holidays. The specific dates for these holidays may vary from year to year.

- 1 Jan 2024, Monday – New Year’s Day

- 8 Feb 2024, Thursday – Isra Mi’raj

- 10 Feb 2024, Saturday – Chinese New Year

- 11 Mar 2024, Monday – Bali Hindu New Year

- 29 Mar 2024, Friday – Good Friday

- 31 Mar 2024, Sunday – Easter

- 10 Apr 2024, Wednesday – Hari Raya Idul Fitri

- 11 Apr 2024, Thursday – Hari Raya Idul Fitri

- 1 May 2024, Wednesday – Labor Day

- 9 May 2024, Thursday – Ascension of Jesus Christ

- 23 May 2024, Thursday – Waisak Day

- 1 Jun 2024, Saturday – Pancasila Day

- 17 Jun 2024, Monday – Hari Raya Idul Adha

- 7 Jul 2024, Sunday – Islamic New Year

- 17 Aug 2024, Saturday – Independence Day

- 16 Sep 2024, Monday – Maulid Nabi

- 25 Dec 2024, Wednesday – Christmas Day

Annual Leave

Employees in Indonesia are entitled to 12 days of annual leave per year. Additionally, there is a form of shared leave known as ‘Cuti Bersama’, where all employees take leave on the same day. This initiative is designed to promote domestic tourism.

Sick Leave

Under Indonesian law, employers are not obligated to offer a specific number of sick days to employees. Sick pay may be adjusted depending on the duration of the employee’s absence from work.

During the initial four months of sickness, employees are entitled to receive 100% of their pay. However, for periods of sickness exceeding four months, the employee’s pay may be reduced by 25%. If an employee remains sick for more than 12 months, the employer has the legal right to terminate their employment.

Other Leave Types

- Maternity Leave: Expectant mothers in Indonesia are entitled to three months of paid maternity leave. Typically, half of this leave is utilized before the child’s birth, with the remaining half taken after the birth. Maternity leave is paid at the full amount of the mother’s wages. On the other hand, fathers in Indonesia are entitled to two days of paternity leave.

- Family Leave: Employees in Indonesia are entitled to paid family leave in specific situations, including:

- Circumcision of the employee’s child

- Baptism of the employee’s child

- Marriage of the employee’s child

- Death of the employee’s child

During this time off, employees receive their full salary. However, employers are not obliged to pay the usual allowances that employees are entitled to receive.

Terminating an Employee

For fixed-term contracts in Indonesia, the standard termination notice period is 14 days.

Severance pay is calculated at a rate of 1 month’s salary per year of service, with a maximum of 9 months’ salary.

Additionally, there is a provision for “Severance appreciation pay” as a reward for service rendered:

- 3 to 6 years of employment: 2 months’ salary

- 6 to 9 years of employment: 3 months’ salary

- 9 to 12 years of employment: 4 months’ salary

- 12 to 15 years of employment: 5 months’ salary

- 15 to 18 years of employment: 6 months’ salary

- 18 to 21 years of employment: 7 months’ salary

- 21 to 24 years of employment: 8 months’ salary

- Above 24 years of employment: 10 months’ salary

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.