Employer of Record Netherlands

Our Employer of Record in the Netherlands service enables clients to hire employees without the need to operate a local legal entity there.

It makes a big difference to develop a new market with your own personnel on the ground. Particularly for functions related to sales & marketing, business development, distributor management, and service & maintenance, our customers are very satisfied using our Netherlands Employer of Record Service.

Our customers and their local teams can be free of the distractions of administrative tasks and complex local requirements. So you can fully focus on the development of your core business.

If your local business grows large enough, you can easily transfer the employees to your own subsidiary. It also provides a quick exit strategy if necessary. In addition to Netherlands, we offer Employer of Record services in several other countries.

Content:

- Employer of Record Netherlands – FMC Group’s Approach

- Hiring an Employee

- Income Tax

- Typical Benefits

- Visa for the Employees

- Time off Policies

- Terminating an Employee

Get in touch with us

Employer of Record Netherlands - FMC Group's Approach

- Quick, flexible, and easy entry into Netherlands in compliance with local employment laws

- Complete control over business development with your own team

- Good option for building up, managing, and supporting your distributors and key accounts by directly observing local developments and adjusting the strategy whenever necessary

- Using our comprehensive recruitment experience for international clients, we can form a local team that fits your corporate culture.

- Focusing on your core business instead of dealing with the time-consuming and complex local administrative tasks

- Allowing for easy market exit if necessary

- Integrating your employees into our team through motivational events and special meetings

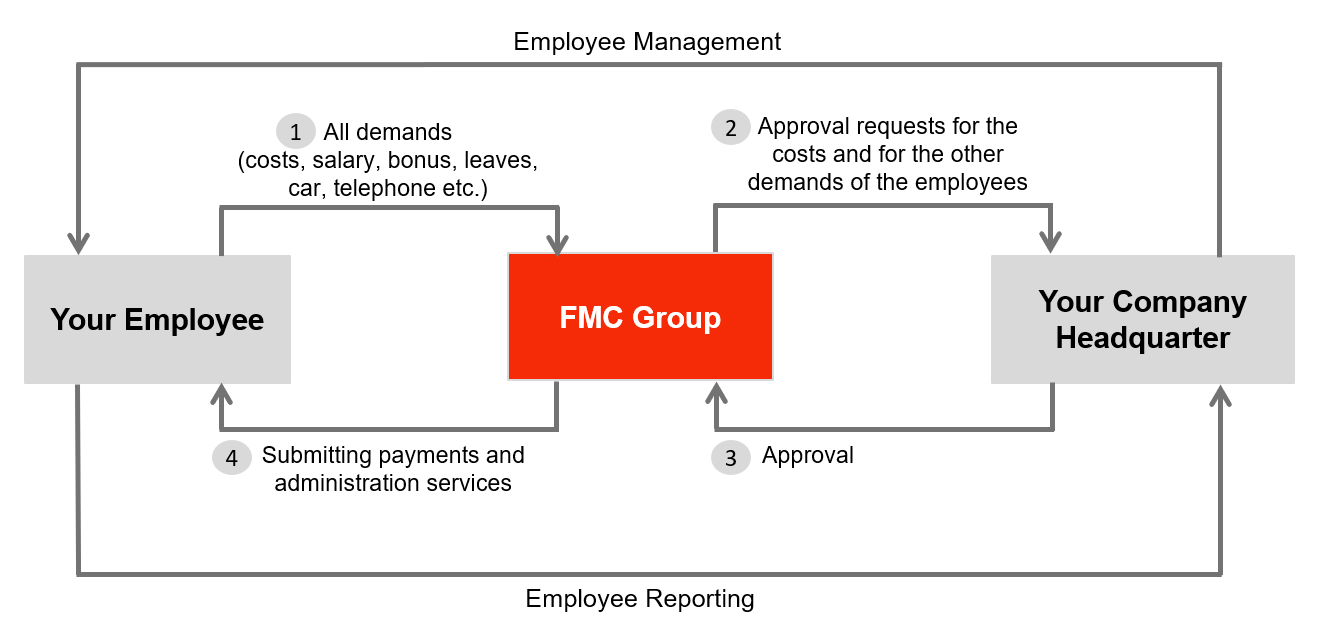

EOR Netherlands Management & Reporting Flow

Hiring an Employee

The Netherlands has comprehensive employment laws, and your business may also be subject to EU regulations. It is crucial to have a thorough understanding of your specific circumstances and the applicable laws before starting operations.

We strongly advise creating a formal written employment contract when hiring in the Netherlands. These contracts should comprehensively outline all essential aspects of the role and the employment arrangement, including salary or wages, benefits, entitlements, and terms of termination. Any references to compensation should be specified in Euros.

Employment Contract – indefinite vs. fixed term

Dutch employment law distinguishes between two main types of employment contracts: fixed-term agreements and permanent agreements.

It’s important to note that temporary contracts cannot be extended indefinitely. According to Dutch regulations, an employee must be offered a permanent contract either after completing three consecutive temporary contracts or after being employed on temporary contracts for a cumulative duration of three years.

Probation Period

In the Netherlands, an employment contract can include a probationary period only if the contract’s duration exceeds 6 months. The specific rules for probation periods are as follows:

- Contracts with a duration of six months to two years: A probation period of up to one month can be stipulated.

- Contracts lasting two years or longer, or those of indefinite duration: A maximum probation period of two months can be included.

During the probation period, both the employer and the employee have the right to terminate the employment relationship immediately, without the need for a notice period or specifying a reason. This allows for flexibility during the early stages of employment.

Work Week, Overtime & Maximum Working Hours

In the Netherlands, the standard working week typically ranges from 36 to 40 hours, with daily working hours averaging 7 to 8 hours from Monday to Friday.

It’s important to note that there is an upper limit on working hours in the Netherlands, which is set at 12 hours per day and 60 hours per week. However, exceeding these limits should be considered an exception rather than a regular practice.

Overtime regulations are not governed by law, so the rates and conditions for overtime compensation are determined by employment contracts or collective bargaining agreements. Typically, overtime pay is either 50% or 100% of regular pay, or employees may receive compensatory time off. For higher-level personnel, overtime is often considered part of their overall salary.

Employees should be aware that they will not receive overtime compensation if they work without an order from their supervisor or if the overtime amounts to less than one hour beyond their standard working hours.

Income Tax

In the Netherlands, individual income tax is levied based on a progressive tax rate system. The income tax rates range from 37.07% to 49.50%, with higher rates applied to higher income levels. This means that individuals with higher incomes are subject to a higher percentage of income tax on their earnings.

| Taxable Income | Tax rate(%) 2024 |

| Up to EUR 75,518 |

36.97 % |

| Over EUR 75,518 |

49.50 % |

Typical Benefits

In the Netherlands, there are both mandatory and non-mandatory employee benefits.

- Mandatory Employee Benefits

- Health insurance

- Pension contributions

- Vacation days

- Non-Mandatory Employee Benefits

- Meal allowance

- Company car and fuel allowance

- Additional annual leave

- Paid relocation services

- Commuter allowance

- Career development allowance

- Increased sick leave

- Private pension fund

- Visa sponsorship

- Dutch language courses

These non-mandatory benefits are typically offered at the discretion of the employer and may vary from one company to another. Employees should check their employment contracts and company policies to understand the specific benefits they are entitled to.

Visa for the Employees

When hiring foreign workers from outside the EU, EEA, and Switzerland in the Netherlands, you will typically need to consider work permits. There are two main types of work permits:

- Work Permit (TWV): This permit is required for employing foreign workers for a duration of less than 3 months. It authorizes the foreign worker to work in the Netherlands for a short-term assignment.

- Combined Work and Residence Permit (GVVA): For employing foreign workers for 3 months or more, you generally need to apply for a combined residence and work permit, often referred to as the “single permit” (GVVA). This single permit combines both the residence and work authorization into one document. It specifies the employer they are allowed to work for and the associated conditions. With the single permit, there is no need for a separate work permit.

The employer can apply for the single permit on behalf of the employee, or the employee can apply for it directly to the Immigration and Naturalisation Service (IND). The choice of which permit to pursue depends on the duration and type of employment for the foreign worker in the Netherlands.

Time off Policies

Public Holidays

- New Year’s Day January 1st

- Easter Monday

- Kings Day April 27th

- Liberation day May 5th

- Ascension Day

- Whit Monday

- Christmas December 25th and 26th

Annual Leave

In the Netherlands, full-time employees are entitled to a minimum of 20 days of statutory paid leave per year. However, employers have the option to grant employees paid leave beyond the statutory minimum if they choose to do so.

It’s important to note that every year, employees must be allowed to take at least the minimum number of days of leave to which they are entitled. Employers are not permitted to object to this request, even on the basis of significant business interests. This ensures that employees have the opportunity to take their statutory leave each year.

Sick Leave

In the Netherlands, when an employee falls ill, it is a requirement for them to notify their employer promptly, ideally on the first day of sickness.

Employers are legally obligated to provide ill employees with salary payments for a period of up to 2 years. The payment of wages during illness is generally calculated as follows:

- The payment is typically 70% of the employee’s last earned salary, unless that salary exceeds the maximum daily wage. In such cases, the continued payment of wages is limited to 70% of the maximum daily wage.

- During the first year of illness, the payment must be at least the statutory minimum wage.

- Employment contracts often specify that the employer will pay either 70% or 100% of the employee’s full salary (with no cap) for the first year of illness and 70% of the employee’s salary (with a possible cap) during the second year of illness.

These provisions ensure that employees who become ill receive financial support during their illness, with the specific payment terms often detailed in their employment contracts.

Other Leave Types

In the Netherlands, the following parental and maternity leave benefits are available to employees:

- Maternity Leave: Expectant mothers who are employed can take up to 16 weeks of paid pregnancy leave, which includes a mandatory 4-week leave period. In the case of multiple births, employees are entitled to 20 weeks of paid pregnancy leave. Typically, 4-6 weeks of pregnancy leave are taken before the expected childbirth date. If the female employee remains unable to work due to pregnancy or childbirth, the leave can be extended.

- Paternity Leave: The partner of an employee who has given birth is entitled to paid leave equal to their weekly working hours (usually 5 working days for full-time employment) to be taken during the first four weeks after childbirth. In addition, the employee is allowed “short absence leave” for the birth itself. The partner can also take up to 5 weeks of parental leave within 6 months after the child’s birth. During this period, the employee receives full pay through the social security system, up to a maximum of 70% of their daily wage.

- Parental Leave: Parental leave enables an employee to temporarily work reduced hours to care for their child or children. Employees can take parental leave for a maximum of 26 times their working week length, and it can be used within the first 8 years after the child’s birth. Nine of these weeks are paid by the employer and are compensated through the social security system, with the employee receiving 70% of the maximum daily wage. Employers may choose to pay more. The remaining 17 weeks of parental leave can be unpaid, although employers have the option to continue paying (part of) the salary.

These leave options provide support for employees during significant life events such as childbirth and the early stages of parenthood in the Netherlands.

Terminating an Employee

In the Netherlands, the termination of employment contracts follows specific procedures and regulations, which vary depending on the stage of employment:

- Probation Period: During the probation period, both the employer and the employee have the right to terminate the employment relationship with immediate effect, without the need for a notice period or specifying a reason.

- Post-Probation Period: After completing the probation period, an employee can only be terminated if permission is granted by the relevant authorities. Depending on the grounds for termination, permission must be sought from either the Dutch labor authority (“UWV”) or the County Court before initiating the termination. If the authority determines that the employment contract can be terminated, the employee is entitled to a severance payment, known as the transition fee. It’s worth noting that the employee has the option to appeal the decision made by the UWV or the Court.

- Mutually Agreed Termination: Employers and employees also have the option to agree on a mutually accepted termination. However, such agreements must adhere to strict form and content requirements. These mutually agreed terminations typically involve the payment of a severance (transition fee) and can incur legal expenses. Additionally, employees have a 2-week reflection period during which they can withdraw their consent to the termination without specifying a reason.

These regulations ensure that employment contracts in the Netherlands are terminated according to established procedures and that employees are provided with certain protections and opportunities to appeal or reconsider their decisions.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.