Nearshoring to the Czech Republic

The Czech Republic is one of the most famous destinations for nearshoring in Central and Eastern Europe. Besides its strategic location in the heart of Europe, the country is mostly known for its prestigious technical universities and its growing talent pool in the information and communication technologies (ICT) sector. Despite the Czech Republic having slightly higher wages than some other Central and Eastern European countries, the quality and reliability of its infrastructure offset the increased labor cost.

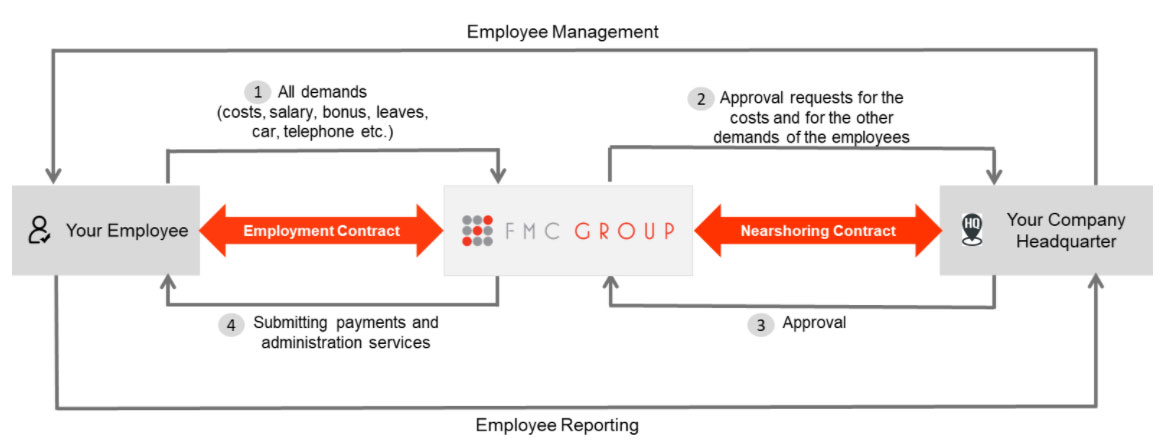

Thanks to the nearshoring services provided by FMC Group, clients wishing to hire from the highly-skilled Czech talent pool can do so with ease. FMC Group completely handles the recruitment process and ensures the selection of the best candidates, allowing clients to benefit from the Czech labor force without setting up a local company. After the recruitment, FMC Group continues to ensure the administrative management of employees, while clients oversee the functions and missions of their workforce.

Content:

- Advantages of Nearshoring to the Czech Republic

- FMC Group’s Nearshoring Approach

- Advantages of Nearshoring with FMC Group

- Labor Laws in the Czech Republic

- Working Hours

- Paid Vacation and Public Holidays

- Other Paid Leaves

- Minimum Wage

- Social Contributions and Taxes

Get in touch with us

Advantages of Nearshoring to the Czech Republic

- The Czech Republic has a highly educated workforce with strong business and technical skills. The fields of science, engineering, and technology are the most common disciplines pursued by Czech university students. The country counts more than 27,300 university students and graduates in ICT programs and over 200,000 workers in the ICT sector.

- The Czech workforce is highly-fluent in English. According to the 2021 EF English Proficiency Index, the Czech Republic ranks 27th in the world. German and Russian are also commonly-spoken in the country, with German taught in schools, while Russian is more common among the older generation.

- The Czech Republic has significantly lower wages than its Western European counterparts. While average salaries vary highly between regions, they remain significantly low considering the quality of the Czech labor force and infrastructure – except in the capital, Prague, where wages almost match Western European cities. The monthly gross salaries for software developers can be as low as EUR 1,450 in the country’s eastern regions, but they increase to an average of EUR 3,100 in the Prague region.

FMC Group’s Nearshoring Approach

Selection and Interviews

- Preselecting candidates based on the client’s requirements;

- Conducting interviews with preselected candidates;

- Establishing detailed reports on the best candidates;

- Conducting personality tests if requested.

Recruitment

- Presenting the interview results to the client in a video format or other formats if needed;

- Hiring the successful candidates and inviting them to work at our office in the Czech Republic.

Operations

- Ensuring the administrative management of employees and communicating their day-to-day requests;

- Paying salaries and other expenses and monitoring paid leaves;

- Providing the tools and infrastructure required by the employees.

Advantages of Nearshoring with FMC Group

- Searching for candidates that match the client’s conditions;

- Adapting job advertisements to fit the jobs and the client’s requirements;

- Preselecting candidates, conducting interviews, checking references, and negotiating contracts;

- Giving the client full management of the employees’ functions;

- Reducing labor costs and eliminating costs related to the establishment of a local company in the Czech Republic.

Labor Laws in the Czech Republic

Working Hours

- Working hours in the Czech Republic are legally limited to 40 hours per week and nine hours per day.

- Additional work over the limit is considered overtime and it cannot exceed eight hours per week and 150 hours per year.

- Overtime work is paid at a rate of 125% of the regular wage.

Paid Vacation and Public Holidays

- Czech employees are legally entitled to 20 days of paid leave per year, but most employers in the Czech Republic give their employees 25 days.

- Employees become eligible for the annual paid leave after they complete 60 days of work for their employer.

- The Czech Republic commemorates 14 public holidays:

- January 1st: New Year’s Day and Restoration of the Czech Independence Day

- Between late March and late April: Good Friday and Easter Monday

- May 1st: Labor Day

- May 8th: Liberation Day and Mother’s Day

- July 5th: Saint Cyril and Methodius Day

- August 21st: Day of Memory

- September 28th: Saint Wenceslas Day

- October 28th: Independent Czechoslovak State Day

- November 17th: Struggle for Freedom and Democracy Day

- December 24th – 26th: Christmas Holiday

Other Types of Leave

- Maternity Leave: Women in the Czech Republic can take up to 28 weeks of maternity leave or 37 weeks for multiple births. They can take the leave from eight weeks before delivery and its mandatory minimal duration is 14 weeks. Social Security covers the employees’ pay during the leave at a rate of 70% of the regular salary.

- Paternity Leave: New fathers can take up to one week of paid paternity leave up to six weeks after their child is born. Social Security covers the employees’ pay during the leave at a rate of 70% of the regular salary.

- Parental Leave: After the end of the maternity leave, parents can request unpaid parental leaves to care for their children until they become four years old. To financially cover parental leaves, the Czech Labor Office gives a one-time allowance of CZK 300,000 (~EUR 12,190) for a single birth or CZK 450,000 (~18,290) for multiple births.

- Sick Leave: Czech employees can take paid sick leave for up to 380 consecutive days. Employers have to pay their employees during the first 14 days of the leave at a rate of 60% of the regular wage. Meanwhile, Social Security covers pay for the remaining duration.

- Bereavement Leave: Employees can take up to three days of paid leave after the death of an immediate family member.

- Family Leave: Employees with a child under 10 years old or a senior family member can take up to nine days of paid leave per year to take care of them.

Minimum Wage

- The minimum wage in the Czech Republic is set at CZK 16,200 (~EUR 658) per month.

- The 13th-month bonus salary is a common practice in Czech companies, but it is usually performance-based.

Social Contributions and Taxes

- Employers in the Czech Republic have to pay 33.8% of their employees’ gross salary as social contributions, which include 24.8% for Social Security and Pension, 9.0% for Health Insurance, 2.1% for Sickness Insurance, and 1.2% for Unemployment Insurance.

- Employees have to pay 11.0% of their gross salary as social contributions, which include 6.5% for Social Security and Pension and 4.5% for Health Insurance.

- The employee income tax in the Czech Republic is set at 15.0% for employees whose income does not exceed CZK 1,867,728 (~EUR 76,000) per year and 23.0% for employees with higher revenue.

Further Useful Information

- Please see the Czech Ministry of Labor for more information on labor laws in the Czech Republic.