Nearshoring to Poland

Thanks to the quality of its higher education and the size of its talent pool, Poland offers some of the most advantageous nearshoring opportunities in Central and Eastern Europe. With more than 300,000 new university graduates every year, including mostly graduates in the fields of business administration and IT, the Polish labor force is consistently growing in both size and quality. Polish professionals are not only known for their high skills in their chosen fields but also their reputable work ethics and proficiency in English.

When nearshoring to Poland with FMC Group, clients gain immediate access to this world-renowned labor force and can quickly put its skills and expertise to use for the benefit of their business. Nearshoring with FMC Group does not only eliminate the requirement of setting up a local subsidiary in Poland but also provides comprehensive administrative and logistical support for clients, allowing them to fully benefit from the potential that the local labor force offers.

Content:

- Advantages of Nearshoring to Poland

- FMC Group’s Nearshoring Approach

- Advantages of Nearshoring with FMC Group

- Labor Laws in Poland

- Working Hours

- Paid Vacation and Public Holidays

- Other Paid Leaves

- Minimum Wage

- Social Contributions and Taxes

Get in touch with us

Advantages of Nearshoring to Poland

- Poland has a world-renowned education system that helps create a highly-skilled and tech-savvy young labor force. The country ranked very high in the latest PISA ranking, which assesses more than 600,000 students’ levels in math, sciences, and reading in 79 different countries. Poland ranked third in Europe and 10th worldwide in the math category, third in Europe and 12th worldwide in sciences, and fourth in Europe and 10thworldwide in reading.

- Poland has around 350 institutes of higher education, which produce around 300,000 graduates every year. The most popular fields in Polish universities are business and administration, followed by technology and industry.

- Poland has a population that is well-versed in foreign languages, notably English, French, and German, which are included in higher education curricula. According to the 2021 EF English Proficiency Index, Poland ranks 16th in the world.

- Poland has competitive labor costs compared to its Western European counterparts, with average monthly gross salaries ranging between PLN 4,721 (EUR 1,016) and PLN 6,597 (EUR 1,421), depending on the region.

- Poland has the largest IT talent pool in Central and Eastern Europe, with more than 400,000 professionals. The overall value of the IT sector in Poland is estimated to be around 70 to 85 billion PLN (15 – 18.2 billion EUR).

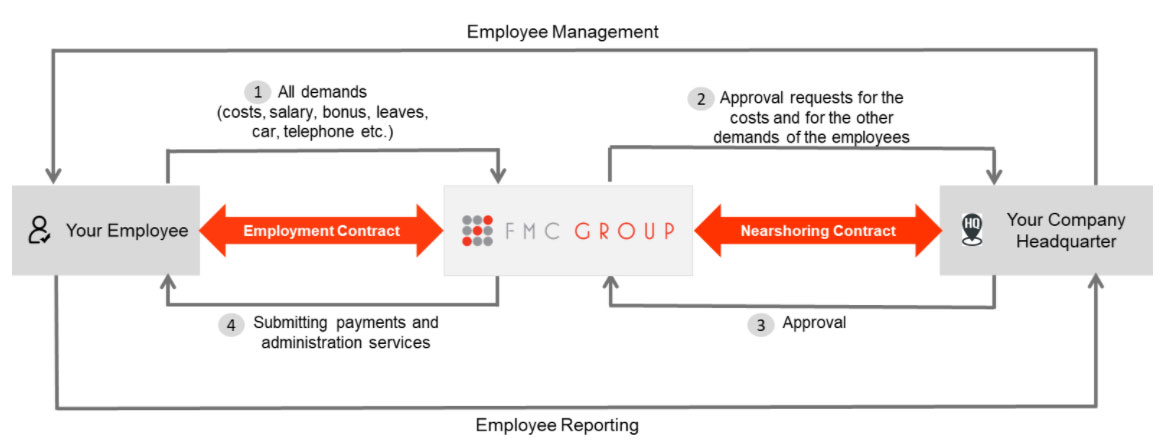

FMC Group’s Nearshoring Approach

Selection and interviews

- Preselection of candidates based on the client’s conditions;

- Preparation of reports on the best candidates;

- Conduction of hiring interviews;

- Conduction of personality tests or other types of examinations if requested.

Recruitment

- Providing the client with video recordings of the interviews to make the final recruitment decision;

- Employing successful candidates at the local FMC Group office in Poland.

Operations

- Handling the administrative side of employee management (payments, social contributions, paid leaves, contracts, etc.);

- Giving the client total control over the employees’ functions and tasks;

- Providing all the necessary tools for employees to achieve their tasks.

Advantages of Nearshoring with FMC Group

- Tailored candidate search based on the client’s specific needs and requirements;

- Adapted job advertisements on various digital platforms;

- Search for fitting candidates on FMC Group’s growing talent database;

- Conduction of the entire recruitment process, from preselection and interviews to negotiations and contract signing;

- Full alignment with local laws and regulations;

- No need for clients to set up a local subsidiary.

Labor Laws in Poland

Working Hours

- Employees in Poland can work up to 40 hours per week and eight hours per day.

- Overtime work’s pay is 50% higher than the regular salary on weekdays and it is doubled on Sundays and public holidays.

- Overtime work in Poland cannot exceed eight hours per week and 150 hours per year.

Paid Vacation and Public Holidays

- During their first 10 years of service, employees in Poland are entitled to 20 days of annual paid vacation. From the 11th year, they can take 26 days per year.

- Employees can take their annual vacation until September 30 of the following year.

- Poland celebrates 11 public holidays:

- January 1st: New Year’s Day;

- January 6th: Epiphany;

- Between early April and early May: Easter Monday (moveable);

- May 1st: Labor Day;

- May 3rd: Constitution Day;

- Between mid-May and mid-June: Pentecost (moveable);

- Between late May and late June: Corpus Christi (moveable);

- August 15th: Polish Armed Forces Day & Assumption of Mary;

- November 1st: All Saint’s Day;

- November 11th: Independence Day;

- December 25th and 26th: Christmas Holiday

Other Paid Leaves

- Maternity Leave: Female employees who give birth or adopt a child are entitled to a fully paid maternity leave, covered by Social Security. The duration of the leave is 20 weeks for one child, 31 weeks for two, 33 weeks for three, 35 weeks for four, and 37 weeks for five or more.

- Paternity Leave: Male employees whose partner gives birth or who adopt a child are entitled to two weeks of paternity leave, which can be taken within the first two years from birth or adoption. They receive their full salary during this leave, covered by Social Security.

- Parental Leave: Employees can take 32 weeks of parental leave after the end of maternity and paternity leaves. During the first six weeks of the leave (or eight weeks if multiple children are born or adopted), employees receive their full salary covered by Social Security. Afterward, they receive 60% of their regular salary until the end of the leave.

- Sick Leave: Young employees who are less than 50 years old can take 33 days of paid sick leave per year, which is paid for by the employer at a rate of 80% of the regular salary. If the illness persists for more than 33 days, pay becomes covered by Social Security. For senior employees older than 50 years, the duration paid for by employers is reduced to 14 days.

- Special Needs Leave: Employees with disabilities can take 10 additional days of paid leave per year.

- Child Care Leave: Employees with a child below the age of 14 can request two extra days of paid vacation every year.

- Special Events Leave: In the case of the death or marriage of a close family member, employees can take two days of paid vacation.

Minimum Wage

- The minimum gross salary per month in Poland is set at PLN 3,010 (EUR 648).

- The payroll in Poland is managed on a monthly basis. Salaries have to be paid before the 10th day of the following month.

Social Contributions and Taxes

- Employers in Poland have to pay a social contribution of 20.48% of their employees’ gross salary, which includes 16.26% for Pensions and Disability Insurance, 2.45% for the Labor Fund, 1.67% for Accident Insurance, and 0.10% for the Employee Guaranteed Benefits Fund.

- Employees pay 22.71% of their gross salary as social contributions, divided between Pensions (11.26%), Health Insurance (9.00%), and Sickness Insurance (2.45%).

- Employees with revenue below PLN 120,000 (EUR 25,830) per year have to pay an income tax of 17%.

- Employees with yearly revenue of more than PLN 120,000 have to pay a 32% income tax, in addition to a fixed tax of PLN 15,300 (EUR 3,294).

Further Useful Information

- Please see Poland Ministry of Labor for more information on labor laws in Poland.