Employer of Record India (EOR India)

India, the world’s second-most populated country, provides access to a market of over 1.3 billion people. The country also benefits from a strategic location, which has placed it at the crossroads of global trade routes for millennia. As a result, India is a prime destination for companies looking to grow their operations in the Asia-Pacific region at a low cost.

FMC Group’s EOR India service enables firms to explore their potential in the enormous Indian market without having to establish a local company and dealing with complex local laws. This provides clients with enormous flexibility, allowing them to increase or decrease their investment along their development potential. It also assists firms in drastically reducing the time and financial costs associated with growing into India.

Content:

- Advantages Employer of Record India

- EOR Service Offered by FMC Group

- Advantages of the Indian Market

- Hiring in India

- Minimum Wage and Payroll

- Social Contributions and Taxes

- Working Hours and Overtime

- Vacation Days

- Parental Leave and Sick Leave

- Notice Period

Get in touch with us

Advantages Employer of Record India

- EOR India enables companies to quickly and affordably extend their operations into the huge Indian consumer market.

- Through tailored job advertisements and a stringent hiring process, our service helps companies in attracting the best candidates from a large talent pool.

- By expanding into India through EOR, companies gain control of a highly skilled local team that is acquainted with the Indian business environment and the numerous opportunities it provides.

- Employer of Record allows businesses to expand into India without having to set up a local subsidiary or deal with administrative and legal hurdles.

EOR Service Offered by FMC Group

- We select candidates who are a perfect fit for your company’s requirements.

- With qualified applicants, we negotiate and sign employment contracts in compliance with local laws.

- We manage payroll in accordance with international standards.

- we pay taxes in India, social contributions, and other expenses.

- We keep track of your employees’ paid time off.

- If necessary, we negotiate and implement private health insurance.

- We keep you up to date on your employees’ management on a daily basis.

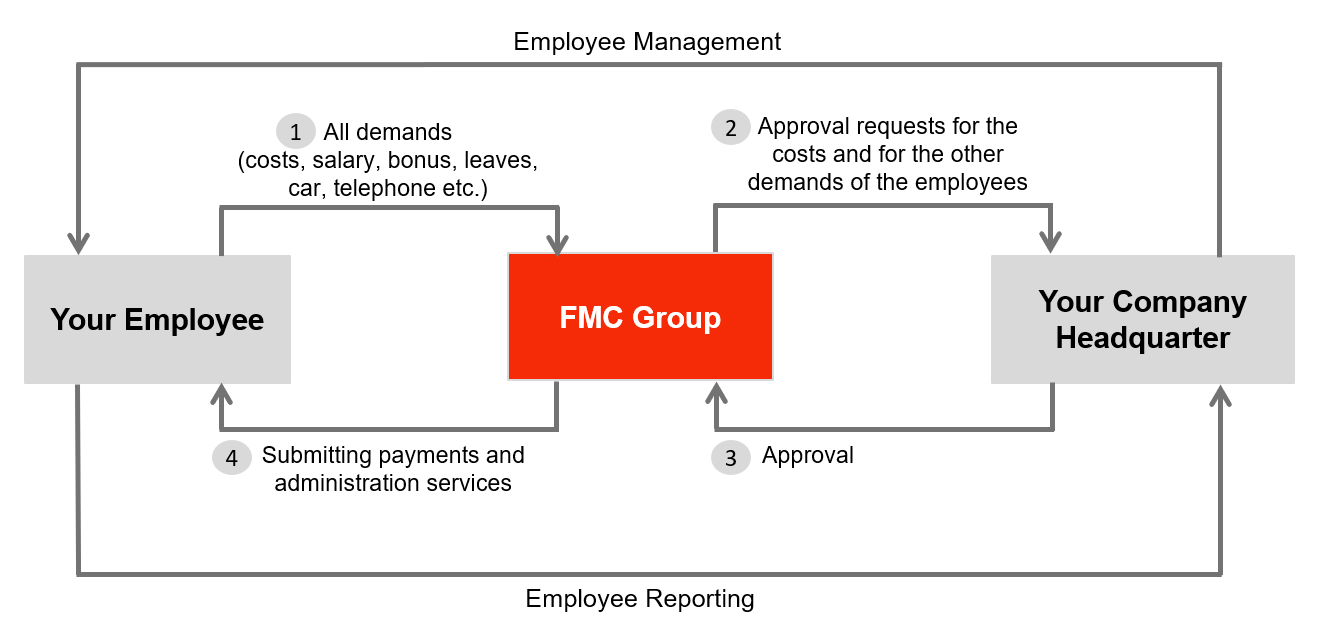

Management and Reporting Flow of EOR Services

Advantages of the Indian Market

- India’s economy is one of the world’s fastest growing. The country received more than USD 83.5 billion in FDI inflows during the fiscal year 2020-2021. The Indian economy is also expected to continue its rapid growth in the coming years. According to the Indian Ministry of Finance, India’s GDP is expected to grow at 9.0% in 2021-2022 and 2022-2023, and 7.1% in 2023-2024, making it the world’s fastest-growing major economy.

- India has the world’s largest youth population, with nearly 380 million people aged 10 to 24 years. This demonstrates that the Indian labor force and consumer market will continue to grow in size for the foreseeable future, providing enormous opportunities for businesses.

- Indian infrastructure is rapidly developing as a result of a national infrastructure investment program aimed at providing world-class infrastructure throughout the country by 2025. With a total budget of more than INR 1,000 billion, the program includes nearly 7,000 projects in the energy, road, and railway sectors (EUR 12.5 billion).

- India serves as a global hub for maritime trade between the Pacific and Indian Oceans. The International North-South Transport Corridor (INSTC), a 7,200-kilometer-long multi-mode transportation network connecting Mumbai, India, and Moscow, Russia, also connects the country to Central Asia and Europe. Because of its importance as a trade hub, India wields considerable economic power throughout the Asia-Pacific region.

- Because of the size of its young talent pool and large investments in education and infrastructure, India has great potential for innovation. The country ranked first in Central and Southern Asia, third in the Lower Middle-Income Economy Group, and 46th overall in the 2021 Global Innovation Index.

- India Investment Grid is a comprehensive living repository showcasing a diverse range of investment opportunities in India.

- The India National Investment Promotion and Facilitation Agency is another useful entity to investigate as an investment destination.

Hiring in India

Minimum Wage and Payroll

- In India, there is no national minimum wage. The minimum wage is set by state governments in each region and is calculated using a formula that takes into account the employee’s geographical location, type of employment, industry, skill level, and seniority.

- Salaries are usually paid on the 28th of each month.

- In the majority of Indian states, the 13th-month salary is required. It is usually paid prior to the end of the fiscal year (March 31st).

Social Contributions and Taxes

| Employer Contributions | |

| Employee’s Provident Fund (EPF) and Employee’s Pension Scheme (EPS) | 12.00% |

| Employee’s State Insurance (ESI) | 4.75% |

| Total | 16.75% |

| Employee Contributions | |

| Employee’s Provident Fund (EPF) and Employee’s Pension Scheme (EPS) | 12.00% |

| Employee’s State Insurance (ESI) | 1.75% |

| Total | 13.75% |

| Employee Income Tax | |

| Less than INR 250,000 (EUR 3,127) per year | 0.00% |

| Between INR 250,001 and INR 500,000 (EUR 3,127 – EUR 6,252) | 5.00% |

| Between INR 500,001 and INR 750,000 (EUR 6,252 – EUR 9,377) | 10.00% |

| Between INR 750,001 and INR 1,000,000 (EUR 9,377 – EUR 12,503) | 15.00% |

| Between INR 1,000,001 and INR 1,250,000 (EUR 12,503 – EUR 15,632) | 20.00% |

| Between INR 1,250,001 and INR 1,500,000 (EUR 15,632 – EUR 18,759) | 25.00% |

| Over INR 1,500,000 (EUR 18,759) | 30.00% |

Working Hours and Overtime

- The legal working hours limit in India is 48 hours per week and nine hours per day, with overtime pay at 200% of the regular salary.

Vacation Days

- After completing 240 days of service, employees in India are entitled to a minimum of 15 days of paid vacation per year.

- Employees must request paid leave at least 15 days in advance of the start date.

- There are only three public holidays encountered in all Indian states:

- Republic Day: January 26th;

- Independence Day: August 15th;

- Gandhi Jayanti: October 2nd.

- State-specific holidays include religious holidays for Hindus, Muslims, Sikhs, Christians, and Buddhists.

Parental Leave and Sick Leave

- Female employees in India are entitled to 26 weeks of fully paid maternity leave following the birth of their first two children. After two births, the leave is reduced to 12 weeks. Social security covers the salary.

- Male employees in the public sector are entitled to 15 days of paid leave following the birth of their child, but there are no statutory paternity leaves in the private sector.

- In India, employees are entitled to 15 days of paid sick leave per year. Sick pay is calculated at 70% of regular salary and is paid for by the employer.

Notice Period

- In India, the minimum notice period is 30 days.

Disclaimer: Although we carefully researched and compiled the above information, we do not give any guarantee with respect to the actuality, correctness, and completeness.